The Reserve Bank of India (RBI) has left its key interest rates unchanged for a third straight meeting but signalled tighter policy if food prices drive inflation higher.

The monetary policy committee, which has three members from the central bank and a similar number of external members, held the benchmark repurchase rate (repo) at 6.50 per cent in a unanimous decision.

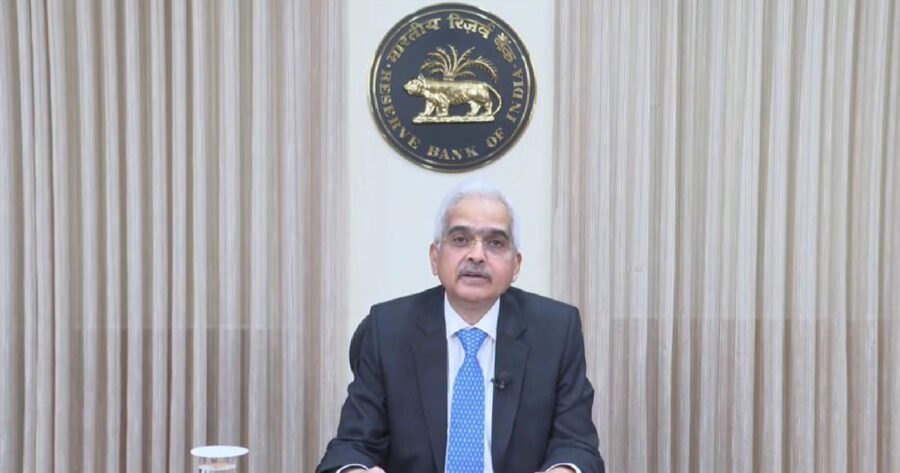

It retained the stance on “withdrawal of accommodation” but Governor Shaktikanta Das sounded hawkish when he highlighted that headline inflation needs to subside sustainably below 4 per cent and any surge in the inflation print, if continued for a longer period, may necessitate fresh action.

Meanwhile, Reserve Bank also proposed to increase the per transaction payment limit to Rs 500 for UPI Lite in offline mode and announced other measures to further deepen the reach and use of digital payments in the country.

Presently, a limit of Rs 200 per transaction and an overall limit of Rs 2,000 per payment instrument has been prescribed by the Reserve Bank for small value digital payments in offline mode, including for National Common Mobility Card (NCMC) and UPI Lite.

By removing the need for two-factor authentication for small value transactions, these channels enable faster, reliable, and contactless mode of payments for everyday small value payments, transit payments etc.

“Since then, there have been demands for enhancing these limits. To encourage wider adoption of this mode of payments and bring in more use cases into this mode, it is now proposed to increase the per transaction limit to Rs 500,” RBI Governor Shaktikanta Das said.

The overall limit is, however, retained at Rs 2,000 to contain the risks associated with relaxation of two-factor authentication and instructions in this regard will be issued shortly, he added.

[the_ad id=”55722″]