Image : (Purely Representational Purpose Only)

The rupee depreciated 47 paise to close at 88.69 against the American currency on a strong US dollar, weak domestic markets, and a hawkish US Fed.

Forex traders said the US Federal Reserve slashed interest rates by 25 bps in its Federal Open Market Committee (FOMC) meeting.

However, Fed Chair Jerome Powell’s commentary was hawkish, trimming rate-cut expectations for December. Moreover, month-end dollar demand from Oil Marketing Companies (OMCs) and foreign fund outflows may also weigh on the rupee.

At the interbank foreign exchange market, the rupee opened at 88.37, and later fell to an intra-day low of 88.74. The local unit finally settled at 88.69 against the greenback, registering a loss of 47 paise from its previous close.

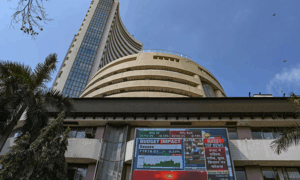

Equity markets fell sharply with the Sensex tumbling 592.67 points and the Nifty declining to 25,877.85 level, as fresh foreign fund outflows and no clarity on the future course of rate action by the US Federal Reserve dampened investors’ sentiment.

The 30-share BSE Sensex tanked 592.67 points or 0.70 per cent to settle at 84,404.46. During the day, it dropped 684.48 points or 0.80 per cent to 84,312.65. The 50-share NSE Nifty tumbled 176.05 points or 0.68 per cent to 25,877.85.

From the Sensex firms, Bharti Airtel, Power Grid, Tech Mahindra, Infosys, Bajaj Finance and Reliance Industries were among the major laggards. However, Larsen & Toubro, Bharat Electronics, UltraTech Cement and Maruti were among the gainers.