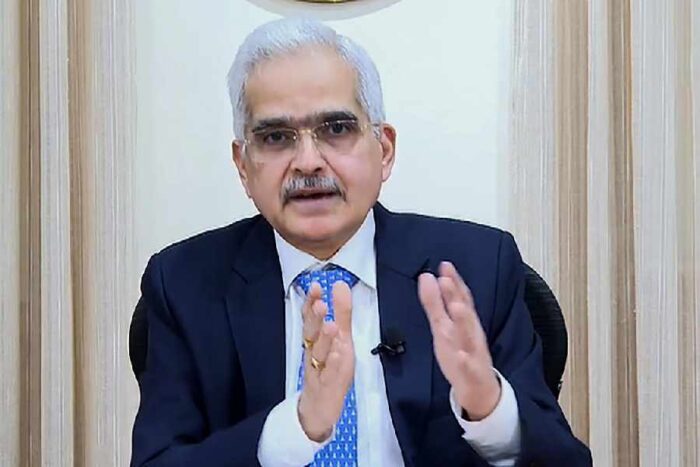

File Picture

Reserve Bank of India (RBI) will launch the Unified Lending Interface (ULI) nationwide in due course, aiming to transform India’s lending sector, similar to how the Unified Payments Interface (UPI) revolutionised the payments ecosystem, Governor Shaktikanta Das said .

According to PTI, The new platform will provide lenders consent-based digital access to customer’s financial and non-financial data — including land records — stored in various silos to help them extend frictionless credit, especially to farmers and micro, small, and medium enterprises (MSMEs).

Currently, credit appraisal is not seamless as data is available on different silos like central and state governments, local authorities, banks and identity authorities.

ULI will cut down the time taken for credit appraisal, especially for smaller and rural borrowers.

“Continuing on this journey of digitalisation of banking services, last year we launched the pilot of a technology platform that enables frictionless credit. From now on, we propose to call it the ULI,” said Das at the Global Conference on Digital Public Infrastructure and Emerging Technologies.

“The ‘new trinity’ of JAM-UPI-ULI will be a revolutionary step forward in India’s digital infrastructure journey,” the RBI governor said.

In banking parlance, JAM is a short form of Jan Dhan, Aadhaar, and mobile. It is used to transfer cash benefits directly to the bank account of the intended beneficiary.

According to Das, by digitising access to customer’s financial and non-financial data that otherwise resided in disparate silos, ULI is expected to cater to large unmet demand for credit across various sectors, particularly for agricultural and MSME borrowers.

[the_ad id=”55725″]