The Reserve Bank of India is likely to keep key policy rates, including repo and reverse repo rates, unchanged in its monetary policy review to be announced on Thursday against the backdrop of Union Budget 2022-23 and growing inflationary concerns.

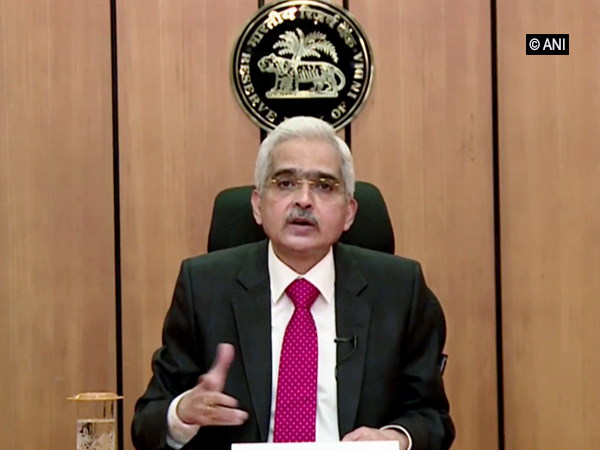

The six-member Monetary Policy Committee headed by Reserve Bank of India Governor Shaktikanta Das started deliberations on the bi-monthly policy review on Tuesday and is scheduled to make the announcements on February 10.

The meeting was originally scheduled to take place on February 7-9, 2022. However, it was rescheduled to February 8-10 after the Maharashtra government declared February 7 as a public holiday to mourn the death of legendary singer Bharat Ratna Lata Mangeshkar.

This policy review is particularly important as it comes just nine days after the 2022 budget announcements. Also, this is the last policy review of the financial year 2021-22.

Analysts and industry leaders feel that the RBI is unlikely to change key policy rates this time and may increase the rates in April.

“Union Budget 2022 has stressed on growth rather than fiscal consolidation, clearly indicating its priority. In order to support this, the RBI should maintain the low interest rate regime and keep the policy repo rate unchanged in its monetary policy,” said Mahesh Desai, chairman, Engineering Export Promotion Council (EEPC) of India.

“We are yet to see economic recovery taking roots and the spurt in high-frequency numbers may be the result of pent-up demand due to restrictions imposed to contain virus spread. The contact-intensive sectors are struggling and trying to come out of the long pandemic shadow,” Desai added.

The RBI has not changed key policy rates for over one-and-a-half years.

The last time the RBI changed policy rate was in May 2020 when it had slashed the key interest rates to a historic low to support the economy ravaged by the Covid-19 pandemic.

The repo rate, the interest rate at which the RBI lends short-term funds to banks, was slashed to 4 per cent. The reverse repo rate, the interest rate at which the RBI borrows from banks, was reduced to 3.35 per cent in May 2020.

These policy rates have remained unchanged since May 2020.

In the last policy review announced on December 8, 2021, the Monetary Policy Committee took a unanimous decision to maintain the status quo on policy rates. The committee had also decided to maintain an “accommodative policy stance.”

[the_ad id=”41101″]