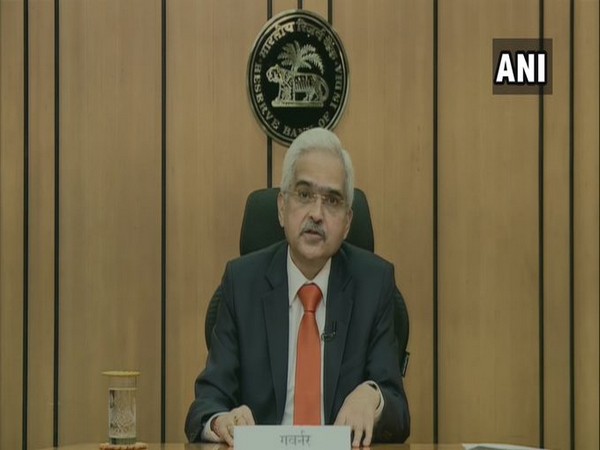

File Picture

A sudden surge in COVID-19 cases and the government’s recent mandate asking the central bank to keep retail inflation around 4 per cent are likely to prompt the Reserve Bank to maintain status quo on policy rates at its first bi-monthly monetary policy review for the current fiscal, according to experts.

The Monetary Policy Committee (MPC), RBI’s rate-setting panel, is also likely to maintain the policy stance accommodative at the next policy review to be unveiled on April 7, say experts.

RBI Governor Shaktikanta Das headed six-member MPC is scheduled to meet from April 5 to 7. The policy meet outcome will be announced on April 7.

The RBI, experts feel, will wait for an opportune time to announce monetary action with a view to ensure the best possible outcome in terms of pushing growth without sacrificing the main objective of containing retail inflation at 4 per cent with a margin of 2 per cent on either side.

The policy repo rate or the short-term lending rate is currently at 4 per cent, and the reverse repo rate is 3.35 per cent

On the forthcoming monetary policy, Edelweiss Research said economic recovery is still uneven and the pace of improvement has slowed of late after sharp rebound from lows. Further, the recent rebound in Covid cases poses a fresh challenge.

It said the growth and inflation dynamic warrants continued policy support, especially with rising covid cases domestically.

[the_ad id=’22722′]