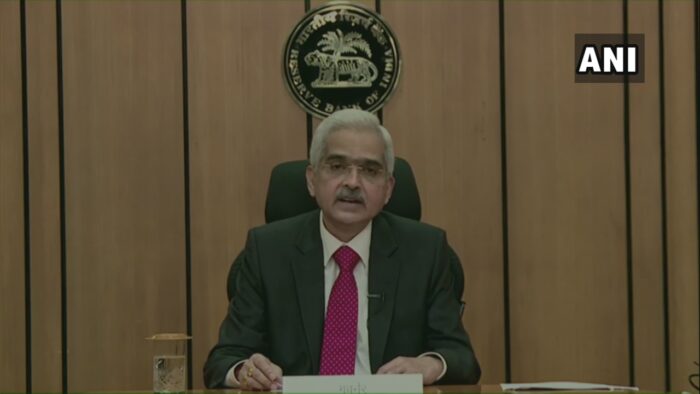

Picture : Twitter / ANI

The Monetary Policy Committee (MPC) voted unanimously to keep policy repo rate unchanged at 4%.Thus maintaining status quo for the second time in a row. MPC also decided to continue with the accommodative stance of monetary policy as long as necessary at least through the current financial year and next year. This was announced by Shaktikanta Das, RBI Governor.

RBI had last revised its policy rate on May 22, in an off-policy cycle to perk up demand by cutting interest rate to a historic low.

For the year 2021, real GDP is expected to decline by 9.5% with risks tilted towards the downside.

Marginal Standing Facility Rate & bank rate remains unchanged at 4.2% and the reverse repo rate stands unchanged at 3.35%.

It is to be noted that MPC meeting earlier slated between September 29 and October 1 was deferred for the first time as government failed to appoint external members before the scheduled date.

The government moved the interest rate setting role from the RBI Governor to the six-member MPC in 2016. Half of the panel, headed by the Governor, is made up of external independent members.

MPC has been given the mandate to maintain annual inflation at 4 per cent until March 31, 2021, with an upper tolerance of 6 per cent and a lower tolerance of 2 per cent.

[the_ad id=’22722′]