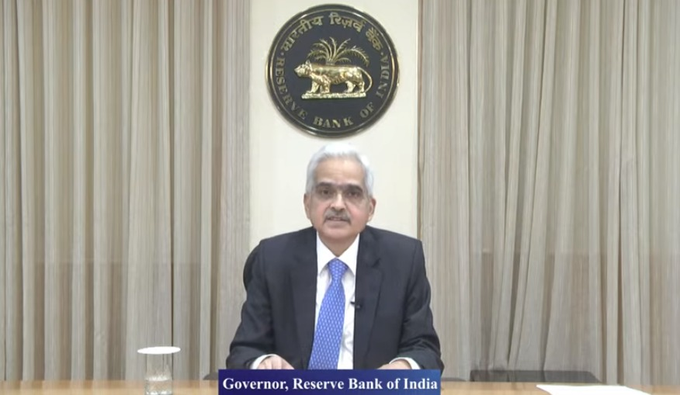

Picture : Twitter / ANI

RBI hikes repo rate by 50 basis points to 5.4% with immediate effect announces, RBI Governor Shaktikanta Das. This is the third hike since the beginning of the current financial year.

The decision was taken at the second bi-monthly meeting of the RBI Monetary Policy Committee which began on Wednesday.

“The real GDP growth projection for 2022-23 is retained at 7.2% with Q1- 16.2%, Q2- 6.2%, Q3 -4.1% and Q4- 4% with risks broadly balanced. The real GDP growth for Q1 2023-24 is projected at 6.7%.

Inflation is projected at 6.7% in 2022-23; CPI inflation for Q1- 2023-24 is projected at 5%,” says Das.

“In an ocean of high turbulence and uncertainty, Indian economy is an island of macroeconomic and financial stability,” Das told reporters during the post policy press conference.

He said the financial stability, macroeconomic stability and resilience of growth is being witnessed despite two Black Swan events happening one after the other and multiple shocks. Generally, a Black Swan event refers to an unpredictable event that has negative consequences.

Das did not list out the two Black Swan events that he referred to. In recent times, the coronavirus pandemic and the Russia-Ukraine war have significantly impacted the global economy.

The governor said the monetary policy will be calibrated, measured and nimble, going forward. Inflation has peaked and will moderate but is at unacceptably high levels, he said. He also said the country’s current account deficit will be manageable and the central bank has the ability to manage the gap

[the_ad id=”41101″]