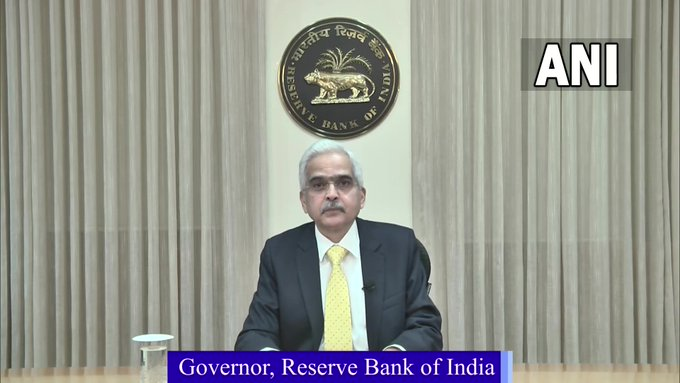

Picture : Twitter/ ANI

The Reserve Bank has hiked key benchmark policy rate by 25 basis points to 6.5 per cent, citing sticky core inflation.

According to Das quoted by ANI, Inflation is projected at 6.5% for the current financial year 2022-23. On the assumption of a normal monsoon, CPI inflation is projected at 5.3% for 2023-24.

This is the sixth time interest rate has been hiked by the Reserve Bank of India (RBI) since May last year, taking the total quantum of hike to 250 basis points.

Announcing the bi-monthly monetary policy, RBI Governor Shaktikanta Das said the Monetary Policy Committee (MPC) by a majority decided to raise the policy repo rate by 25 basis points and keep a ‘strong vigil’ on inflation outlook.

“Policy rate at 6.5 per cent still trails the pre-pandemic level,” Das said, adding that core inflation will remain sticky.

On The GDP growth Das stated, The Real GDP growth for 2023-24 is projected at 6.4% with Q1 at 7.8%, Q2 at 6.2%, Q3 at 6% & Q4 at 5.8%

The global economic outlook doesn’t look as grim now as it did a few months ago, growth prospects in major economies have improved while inflation is on a descent though inflation still remains well-above the target in major economies said Das.

Unprecedented events of the last three years have put to test monetary policy across the world. Emerging market economies are facing sharp tradeoffs between supporting economic activity and controlling inflation while preserving policy credibility , Das was quoted by ANI as saying.

[the_ad id=”55722″]