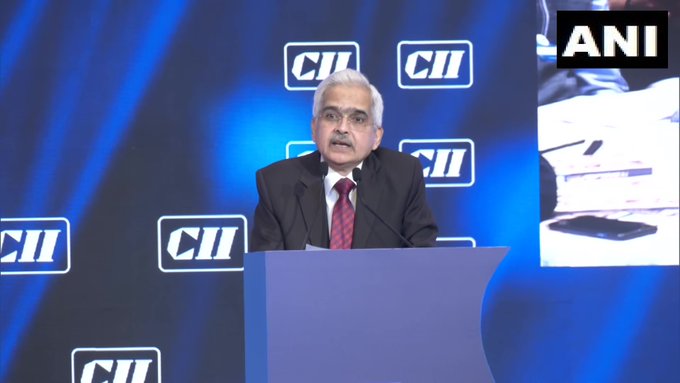

Picture : Twitter/ ANI

Reserve Bank Governor Shaktikanta Das has said the decision to tweak policy rates was not in his hand as he himself is driven by the situation on the ground.

In April, the Reserve Bank in a surprise move hit the pause button and decided to keep the key benchmark policy rate at 6.5 per cent.

Prior to it, the Reserve Bank of India (RBI) was on a rate hiking spree, raising the repo rate by 250 basis points since May 2022.

#WATCH | RBI Governor Shaktikanta Das says, “Financial markets remain volatile as uncertainty over future monetary policy path is keeping market sentiments on the edge…On the upside, global growth is being supported by the easing of supply chain disruptions, gradual… pic.twitter.com/00IlPErKXP

— ANI (@ANI) May 24, 2023

“For the current year — for the year that has just ended that is 2022-23 — the estimates are that it will be 7%. But there is a possibility that it could be even more. The data will come at the end of this month, according to all recent trends, it will not be a surprise if the GDP growth of last year comes slightly above 7%..,” said RBI Governor on the domestic growth scenario as quoted by ANI

Das further explained, Amidst global uncertainties, the Indian banking system remains stable and resilient with strong capital and liquidity positions, improving asset quality, better provisioning coverage and improved profitability