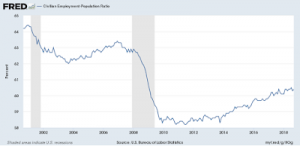

This is reflected in an employment to population ratio that is still below the previous peak, even if now recovering. In other words, the participation rate in the labor market remains relatively low. And, hence, wages have not yet started to pick up significantly, and inflation remains subdued, which casts at least doubts about the meaning of full employment.

This suggests that we would need more fiscal stimulus, and not austerity. That’s one concern I have with some critics of Trumponomics. That they presume that fiscal deficits and Trump’s tax cuts are both bad. I would suggest that the latter is certainly bad, for distributive reasons. But deficits in the current situation in which the recovery has not raised all boats is far from a problem. I think it was Barbara Bergmann (citing Alvin Hansen) that said that the full employment deficit was the fiscal deficit necessary to bring the economy to full employment. We are probably not there yet. Btw, this is what used to be called functional finance and Trump’s critics should learn about it.

Some critics, like Mallaby, are concerned with the trade wars. Here too I’m a bit worried about the positions taken by critics. Progressives have complained about Free Trade Agreements (FTAs) for a long while now. And also criticized the concept of Free Trade (see here for a list of entries in this blog). Mallaby, for example, suggests that the trade war with China, and the new version of NAFTA (USMCA now), which is worse for him than the original (the name for sure, Moreno-Brid suggested at a conference in Mexico this week MEXCUSA, a good pun in Spanish), would reduce productivity and growth.

I still don’t have a full picture of the USMCA deal, but it seems that beyond the clauses about North American content and percent being produced with higher wages in the auto industry (both clauses that seem to favor the US and not Mexico), the liberalization of Canadian dairy industry, and tighter restrictions on generic medications (all of which seem to favor US corporations against Canadian citizens), the most important is the one that allows any member country to essentially veto free trade agreements with non-member countries. That is, most likely, a clause for the US to veto FTAs with China.

In that sense, USMCA is just an extension of the trade war with China. I don’t want to write much on this, but it seems to me that the US finally decided to revert the opening policy towards China, that harks back to Nixon, and to take the Chinese challenge (and at this point it’s just that; I don’t see a Sinocentric world any time soon) seriously. In all fairness, it seems to make a lot of sense, from an American security position to make it difficult for Chinese firms to go about the process of catching up, which includes acquiring companies, reverse engineering, violations of copyrights and patents, industrial espionage and more. And yes, there will be disruption of the commodity chains. For example, maybe Apple will move some of its i-Phone production out of China into other developing countries in the region (don’t think many manufacturing jobs will return to the US though). But productivity won’t suffer much.

If you’re concerned with productivity, fiscal policy and its impact on growth should be a greater concern to you. Expansion of demand is what pushes labor productivity (productivity is not the cause of growth, but the result; search the entries on Kaldor-Verdoorn Law in the blog). The slow recovery is the problem.

Finally, I’m still unsure about when the recession will come, but neither the fiscal or trade fronts, which are the ones attacked mostly by Trump’s critics seems to be the crucial problem. Monetary policy might be though. If the Fed continues to raise rates, something they suggested they would do, then there is a serious possibility of a crisis ahead. Higher rates would affect the already overextended American consumer, and lead to a recession. Nothing like the last one, I think. And the Fed would be forced to reverse course pretty soon. But the Fed remains independent, also something that old critics of the concept have embraced in the Trump era.

Matias Vernengo is Professor of Economics, Bucknell University, USA. This write-up was originally published on his blogroll -NAKED KEYNESIANISM. To read the original article click Here.